May 2025 Housing Market Update | Inflation & Mortgage Rates Outlook

May Market Update: Inflation in Line, Rates Holding Steady

May 2025 Housing Market Trends at a Glance

It’s mid-May and we’re seeing more homes hit the market — but interest rates?

Still stuck in the same range. Whether you’re watching rates as a homeowner or as a buyer on the sidelines, it feels a bit like Groundhog Day.

The average 30-year fixed is hovering near 6.9%, barely above last week. April’s inflation data came in exactly as expected, but uncertainty around the U.S.–China tariff truce is keeping mortgage bond markets in limbo. Until there’s more clarity, expect rates — and the numbers behind refinances, move-ups, or first-time purchases — to stay in this narrow band.

What Makes U.S. Real Estate Still So Attractive?

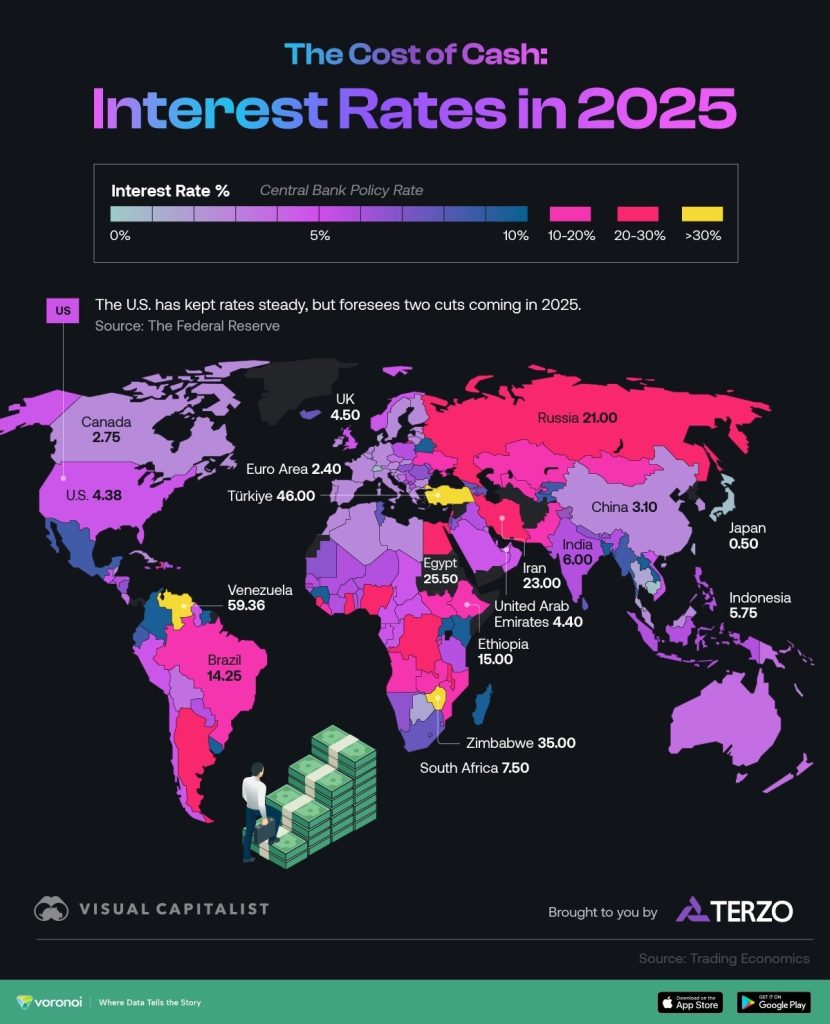

Globally, central banks are still battling inflation, many with double-digit policy rates. Compared to that, U.S. borrowing costs remain relatively modest. Add to that a strong dollar and stable economy, and owning a home in the U.S. still looks like a solid long-term investment.

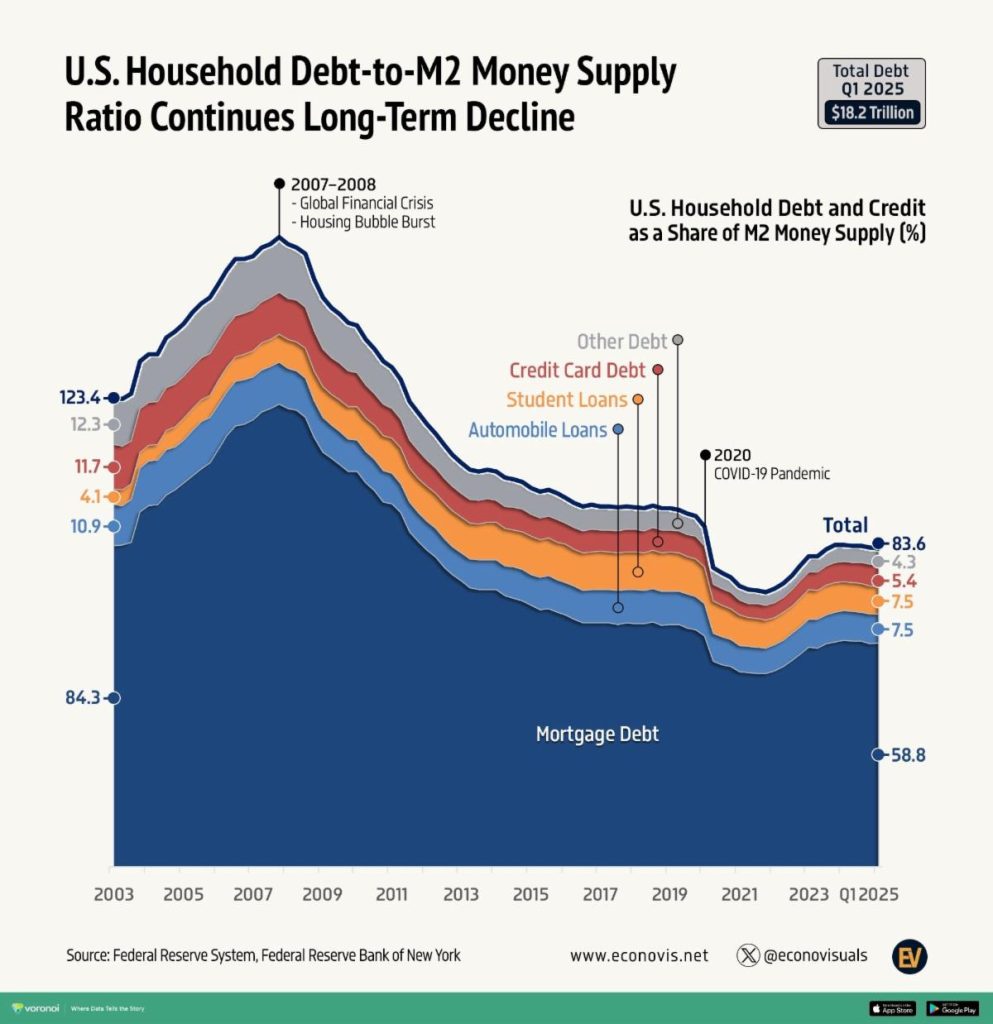

Consider this: Households now owe just 84¢ for every $1 of U.S. cash in circulation, down from $1.23 in 2007. We’re far less leveraged than before the financial crisis, and that keeps global money flowing into U.S. real estate. Rates might feel high, but in the big picture, we’re in a strong position.

Rates Climb Slightly After Trade News

According to Mortgage News Daily, May 12 saw many lenders reprice for the worse, taking average 30-year quotes to their highest since April 27. This bump followed developments in U.S.–China trade talks. While tariff relief is positive for growth, 30% of duties remain, keeping upward pressure on inflation and rates.

April Inflation Data Is Cooling — Shelter Isn’t

April’s CPI rose just 2.3% year-over-year, the lowest since early 2021, and matched expectations. Month-over-month inflation ticked up 0.2%. However, shelter costs — like rent and owners’ equivalent rent — continue to climb around 0.3%–0.4% monthly and 4% annually.

While CPI data suggests progress, housing costs remain sticky, and the Fed is still in “wait and evaluate” mode. For buyers, this means stable but not lower rates — at least for now.

California Housing: More Inventory, Less Affordability

Inventory in California is finally rising, but affordability is hitting new lows:

-

Only 17% of households can currently afford to buy

-

A median single-family home now requires about $5,450/month in payments

-

That equates to about $218,000 in qualifying income — and $334,000 in the Bay Area

Even with more listings, stubborn costs are keeping many out of the market.

Featured Financing Solution: Renovation Loans

Perfect for buyers looking to turn potential into polished — or for sellers hoping to boost market value.

-

🛠️ Finance home purchase and renovation in a single loan

-

🏡 Available for primary, secondary, or investment properties

-

💡 Choose from FHA 203(k) or Fannie Mae Homestyle

-

💵 Renovation budgets based on after-improved value

Quote to Consider

“The best investment on Earth is earth.”

— Louis Glickman

Useful Resources

Ready to Explore Your Options?

Let’s talk through your goals and build a strategy that fits today’s market. Whether it’s a purchase, refinance, or renovation loan — I’ve got you covered.